英特尔迫切期待5G时代的到来,5G可以让更多设备的联网成为可能。

英特尔在IDF 2015上谈到了对5G的一些看法,但这一讨论的重要性却被很多主流媒体忽略了,毋庸置疑,英特尔迫切期待5G时代的到来,5G可以让更多设备的联网成为可能。事实上,电信运营商已经在开始为5G做标准化的准备工作。英特尔透露出来的信息是他们已经开始了5G调制解调器的开发工作,也许可帮助其缩小与高通等移动芯片供应商的距离,以弥补在移动市场上的损失。

Summary

- Intel went into the gory details when it came to 5G at IDF 2015.

- Unfortunately the discussion on 5G flew under the radar as various other developments were given higher importance in the mainstream media.

- Needless to say, the speeds Intel anticipates from 5G are very disruptive. 5G is a strategic enabler to more web-connected devices.

- Of course, Intel isn't speaking out into an empty vacuum. There's confirmation from telecoms that they're beginning to set the standards for 5G.

- This implies that Intel already is working on 5G capable modems, which may mean Intel could close the gap between Qualcomm and start shoring up mobile losses.

The most important thing that came out of IDF 2015 was the keynote pertaining to 5G, which has disruptive implications for the Internet of Things and ties very closely to whether or not Intel can develop a meaningful amount of traction in the mobile space. For the most part, Qualcomm (NASDAQ:QCOM) has been able to maintain its shipment volume due in part to its comprehensive mobile package, which integrates all of the semiconductor components inside of a mobile device, aside from the memory and screen.

Hence, Intel (NASDAQ:INTC) hasn't been able to transition away from its contra revenue. But I do anticipate that losses pertaining to mobile will considerably decline over the next three fiscal years. The low pricing on app processors explains why Intel rebates below its bill of materials. It's not likely that Intel will ever price its mobile chips the same way it prices its desktop and laptop counterparts. Intel needs to scale the production of mobile chips otherwise there won't be any contribution to profits as the developments of mobile CPUs and baseband modems is R&D intensive.

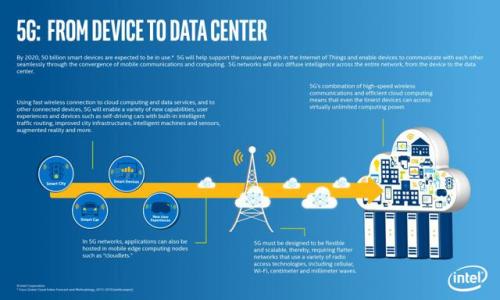

Source: Intel

In Intel's presentation, the company believes that there will be 50 billion devices in use by 2020. While that's a very aggressive forecast, there's no denying the proliferation of various computing devices, which extends the growth potential beyond conventional desktop computers. Of course forecasts vary when it comes to long run semiconductor growth, as Taiwan Semiconductor Manufacturing (NYSE:TSM) recently mentioned on a recent quarterly earnings conference call that growth for the entire industry is expected to range between 4% to 6%. Foundries are expected to grow slightly quicker as they're directly linked to the growth in areas not pertaining to PCs and smartphones.

That being the case the performance aspect is what's really interesting here. At least according to EE Times, the Intel panel anticipates a monumental improvement in speed:

The panel made it clear that their major metric was speed - which they predicted would be 100-to-1000 times faster with sub-millisecond latency, enabling the kind of real time interactivity - such as virtual worlds - which today only exist in science fiction books like William Gibson's Neuromancer which virtually defined the concept of cyberspace as a world on a level-playing-field with nature.

This implies that Qualcomm's upcoming Gobi modems are nowhere near the speeds of 5G. Investors can anticipate uplink and downlink speeds that are substantially better than the projected performance of Snapdragon X12 LTE (Gobi 9x40/9x45 series) upon the introduction of 5G speeds. This moves my timeline for when I expect 5G and the speed that I anticipate from 5G. Currently, the most advanced mobile modem has peak speeds of 450 Mbps on the downlink and 100 Mbps on the uplink. If we were to apply a conservative estimate on how 5G would transform uplink and downlink speeds, we can anticipate 45 Gbps assuming 100x performance scaling. At 1,000x performance scaling we can anticipate 450 Gbps of uplink speed, which will likely be the speed of later generation 5G modems. To put 45Gbps in context, we can compare it to the distributed denial of service attack that hit a large Chinese e-commerce company back in 2011. The server had to continually deny requests from 250,000 infected computers. So by 2020 wireless speeds on a mobile handset will be equivalent to the bandwidth usage of a large-scale network attack from 2011.

Talk about science fiction becoming a reality.

This has interesting implications for network infrastructure because there are two ways to essentially increase speeds. One way is to improve the available spectrum which allows the mobile Internet to travel along more frequency bands. However, the other way is to increase the speed at which data moves within the available spectrum.

Another way of thinking about it - spectrum is the available lanes on the Internet freeway, whereas an improvement to uplink and downlink refers to the speed at which data travels along the Internet freeway. So, to accommodate for more devices accessing the Internet, the implementation of 5G will have to take place, as there's very little spare capacity on 4G networks currently. Verizon (NYSE:VZ) conveys that they can convert more of the available spectrum for 4G, but it's really a short-term solution for accommodating the long-term data needs of 50 billion projected devices. Of course telecoms have to build a network to accommodate for the projected bandwidth needs of more device, which is why I'm very hesitant to recommend the lower-tier networks because their capital spending doesn't really match the long-term data needs of mobile users. Much of this increase in activity will exist at the edge of the network, which will put pressure on content delivery networks to sustain last-mile connections, which currently accounts for a lot of the activity that currently takes place on the web.

Of course, Intel isn't out on a limb making up these numbers, as Verizon mentioned on its second quarter earnings call:

There's a lot of things will bring efficiency to the network. There is C-RAN out there. We are in the initial - obviously 5G is being talked about in the industry. Of course, Asia is involved in 5G and of course we will start to get involved in the standard setting around 5G, so there's a lot happening in this industry for technology standpoint.

If the mobile carriers are also getting involved with the transition to 5G it's safe to bet that the technology is about 5 to 10 years out, as it's extremely unlikely that 4G will sustain the projected explosion in data usage and the current pricing model isn't very appealing to consumers and offers limited viability for growth going forward. Therefore, while the transition to 5G is capex intensive, it also will increase the size of the revenue pool for both telecoms and semiconductors as 5G is a strategic enabler to selling more web-connected devices, which also translates into more billable data for all the network providers.

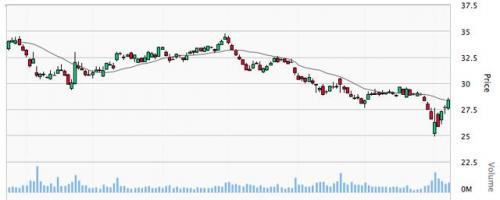

Source: Amigobulls

Intel is starting to recover on the back of a strengthening market sentiment and the positive announcements from IDF 2015. The media went into various technologies that Intel showcased at the event, but what was most important was the discussion of 5G and the upcoming architecture for its CPU-family. That being the case, those two areas are in solid condition as Intel is positioning itself to build better mobile baseband technologies and benchmarks for Skylake were very promising. Intel also communicated that they have more of a five-year to 10-year roadmap for mobile. That's plenty of time for Intel to catch up to Qualcomm, which is why investors have a lot of growth potential over the long haul despite the maturity of the PC-business.

声明: 此文观点不代表本站立场;转载须要保留原文链接;版权疑问请联系我们。